Some Known Incorrect Statements About Medicare Advantage Plans Tampa

Table of Contents9 Easy Facts About Medicare Advantage Plans Tampa ShownSome Known Facts About Medicare Advantage Plans Tampa.How Medicare Advantage Plans Tampa can Save You Time, Stress, and Money.Getting My Medicare Advantage Plans Tampa To WorkThe smart Trick of Medicare Advantage Plans Tampa That Nobody is DiscussingSome Ideas on Medicare Advantage Plans Tampa You Need To KnowMedicare Advantage Plans Tampa Things To Know Before You Buy

You need to have Medicare Parts An and also B to enlist in a MA Choice. MA Strategy Options include Medicare Part D medicine benefits. Individuals who have actually lived a minimum of five years in the USA may purchase Medicare Component B protection even if they did not add to Social Protection or work the variety of necessary quarters.With Medicare Benefit prepares, you could see adjustments in the physicians and hospitals consisted of in their networks from year to year, so call your providers to ask whether they will certainly remain in the network following year. There may likewise be changes to the strategy's vision and dental coverage, in addition to the prescription medicines it covers, states Danielle Roberts, a founder of Boomer Conveniences, a Medicare insurance broker.

Analyze your benefits statements and also medical expenses for the past year, then include up what you paid in deductibles and copays to obtain the real expenses of your plan. Consider what you might pay the following year, if you require, claim, a knee substitute or have an accident.

The 7-Minute Rule for Medicare Advantage Plans Tampa

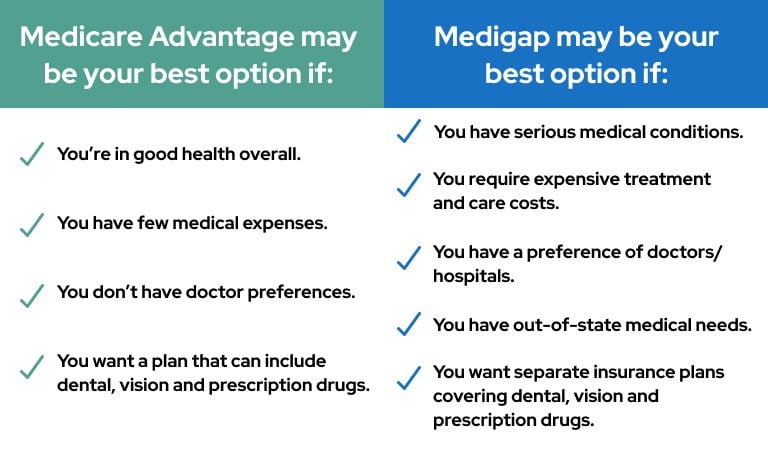

Think about the repercussions of changing. When you at first enlist in Medicare at age 65, you have actually an assured right to buy a Medigap strategy. As well as insurance firms are called for to restore insurance coverage each year as long as you remain to pay your costs. Yet if you shop a Medigap plan after that enrollment window, insurers in many states might have the ability to turn you down or charge you more due to a pre-existing problem, Roberts states.

These strategies are used by insurance provider, not the government government., you need to likewise get Medicare Parts An and B. You can consider the chart above for a refresher course on eligibility. Medicare Benefit plans additionally have particular solution areas they can supply insurance coverage in. These service areas are licensed by the state as well as approved by Medicare.

A lot of insurance policy plans have a web site where you can examine if your doctors are in-network. Keep this number in mind while evaluating your various strategy alternatives.

The Basic Principles Of Medicare Advantage Plans Tampa

This varies per strategy. You can see any kind of provider throughout the united state that approves Medicare. You have a details option of providers to select from. You will certainly pay even more for out-of-network services. You can still get eye take care of clinical problems, yet Original Medicare does not cover eye examinations for glasses or get in touches with.

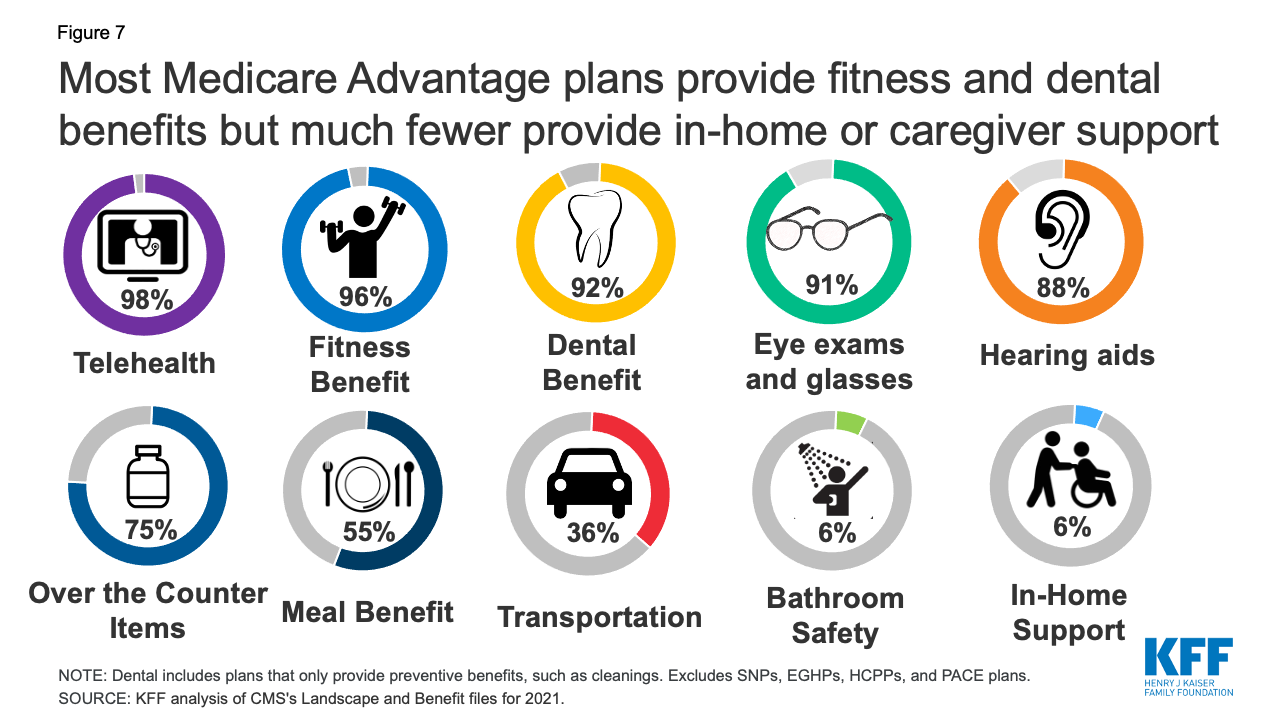

Several Medicare Advantage plans deal additional advantages for dental care. Lots of Medicare Advantage intends offer fringe benefits for hearing-related solutions. You can acquire a different Part D Medicare medicine strategy. It is rare for a Medicare Benefit strategy to not consist of medicine protection. You can have double insurance coverage with Initial Medicare and also other insurance coverage, such as TRICARE, Medigap, professional's benefits, employer strategies, Medicaid, etc.

You can have other twin protection with Medicaid or Unique Requirements Strategies (SNPs).

How Medicare Advantage Plans Tampa can Save You Time, Stress, and Money.

The strategies need to comply with regulations and also standards established by Medicare. The federal government pays Medicare Benefit intends to give all Medicare-covered advantages. If there is a distinction in between the quantity a Medicare Benefit strategy is paid by Medicare and also the strategy's real cost to offer benefits, the plan should use any cost savings to offer fringe benefits or decrease costs for participants of the strategy.

Medicare concerns high quality scores for Medicare Advantage plans. Medicare studies individuals that sign up with a Medicare Advantage plan to gauge the total top quality of the plans, including quality of treatment, strategy members' ability to access treatment, strategy responsiveness and member complete satisfaction. Individual Medicare Benefit strategies are rated on a scale of one to 5 star, with five celebrities being the highest rating.

Medicare Benefit Strategies should cover nearly all of the medically needed solutions that Original Medicare covers. If you're in a Medicare Advantage Plan, Original Medicare will certainly still cover the price for hospice treatment, some brand-new Medicare benefits, and some expenses for professional study studies. Many Medicare Advantage Program deal coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, as well as wellness programs (like fitness center subscriptions).

Little Known Facts About Medicare Advantage Plans Tampa.

Medicare is a Medical Insurance Program for: Individuals 65 years old as well as older. Some people with specials needs under 65 years of age. People with End-Stage Kidney Condition (irreversible kidney failure requiring dialysis or a transplant). Medicare has four components: Component A click (Healthcare Facility Insurance Coverage). Most individuals do not need to spend for Part A.

These are health and wellness care selections (like HMOs) in some areas of the country. In the majority of Medicare handled care strategies, you can only most likely to physicians, specialists, or hospitals that become part of the plan. Medicare took care of care strategies give all the benefits that Original Medicare covers. Some cover bonus, like prescription medications - medicare advantage plans tampa.

The FEHB health insurance plan pamphlets clarify exactly more helpful hints how they work with advantages with Medicare, depending upon the kind of Medicare managed treatment strategy you have. If you are eligible for Medicare protection reviewed this information meticulously, as it will have a genuine bearing on your advantages. The Original Medicare Plan (Original Medicare) is readily available all over in the United States.

Medicare Advantage Plans Tampa for Beginners

You might go to any kind of medical professional, professional, or health center that approves Medicare. The Initial Medicare Plan pays its share as well as you pay your share.

Just call the Social Safety and security Administration toll-fee number 1-800-772-1213 to establish an appointment to use. If you do not request one or even more Components of Medicare, you can still be covered under the FEHB Program. If you can get premium-free Part A protection, we encourage you to register in it.

It is the way everyone used to obtain Medicare advantages and is the way lots of people get their Medicare Part An and also Component B benefits now. You might most likely to any type of doctor, professional, or health center that accepts Medicare. The Original Medicare Strategy pays its share as well as you pay your share.

Medicare Advantage Plans Tampa - Questions

Please consult your health insurance plan for certain information regarding filing your insurance claims when you have the Original Medicare Plan. If you are qualified for Medicare, you may select to enroll in as well as obtain your Medicare benefits from a Medicare Benefit strategy. These are private healthcare options (like HMO's) in some locations of the nation.